E-commerce powered by your Point of Sale

Grow your business on the e-commerce platform with a difference. WebSell® plugs into your Point of Sale, giving you an all-in-one solution, including a responsive website.

Trusted by leading BUSINESSES

Integrated e-commerce has never been easier

Integrate e-commerce with your POS system

Experience seamless integration between e-commerce platform and your POS or ERP system. No more manual data entry!

Create smooth online experiences

Make more sales with responsive and intuitive website designs, optimized around how your customers.

Get the support you need to succeed

Get answers to your questions and issues from real WebSell experts on our responsive support team.

The Complete E-commerce Package

WebSell is a unique platform that combines the best of online retail software with the cream of e-commerce marketing services. Here’s what we bring to the table.

Integrate your POS and website

WE MAKE OMNICHANNEL POSSIBLE.

Our unique software delivers a seamless integration between your POS/ERP system and the WebSell e-commerce platform. WebSell uses the existing data in your Point of Sale system to build your new e-commerce webstore.

With e-commerce integration, the essential in-store, back-office, and online retail systems are integrated through e-commerce. This reduces staff time spent on maintenance, centralizes customer data, and improves efficiency in areas like inventory and fulfillment management.

We believe in the power of our e-commerce software and if you want to have your retail systems work from one ecosystem of information, then WebSell is for you.

Hyper-fast webstores that drive sales

BECAUSE IN E-COMMERCE, SPEED EQUALS SALES.

At WebSell we believe you shouldn’t have to sacrifice speed to have an eye-catching website. We combine the two to create hyper-fast and beautiful shopping experiences that look great on every device.

Omnichannel commerce means giving your customers the same experience no matter where they choose to shop: in-store, on their phones, or on a computer. However they choose to shop, you need to be able to deliver a unified front.

WebSell webstores are designed to be an extension of your brick-and-mortar store, with all the convenience that comes with. Our latest webstore themes have been rebuilt from the ground up around our Next Gen core. Learn more about it below or browse some of our site designs.

Customized development

WHEN YOU NEED A UNIQUE SOLUTION.

With our team of expert developers you can create the exact website experience that you want. You aren’t limited by what you get out of the box (although that’s still pretty good). Custom development makes it possible for your business to get the features and design you need for the best possible customer experience.

WebSell connects to a number of leading payment gateways and shipping providers already. But if you need to connect to a third-party quickly and easily, our custom development team have streamlined the process of setting up and running your e-commerce website the way you want.

Create your the perfect vision of your e-commerce site with WebSell.

Grow more with marketing services

THINKING OUTSIDE THE BOX TO DELIVER REVENUE FOR YOU.

Competition in online retail is a given, so you need to stand out from the crowd. Our digital marketing experts can help your business differentiate and find new sources of revenue online.

With services like PPC, SEO, Email Marketing, and Social Media Marketing, we can help your business grow online. Our team of experts have marketing agency backgrounds that enables us to deliver quality services. Working with our marketing services team you’ll be able to:

- Differentiate your business

- Increase brand awareness

- Drive more sales and revenue

We take the growth of your e-commerce store seriously. We focus on results and sales and we don’t hide from the data.

Become an e-commerce success story

OWN E-COMMERCE AND MAKE IT PART OF YOUR STORY.

Many WebSell retailers are leaders in their industry. By working with our teams on design, development, marketing, and more, they’ve been able to carve their story out.

Many of our retailers were new to e-commerce when finding us and almost all would be lost without their online sales now. Make your store a success story on the e-commerce platform with a difference.

Learn through the stories from our top retailers:

Recognized globally as a leading B2C and B2B e-commerce platform

400+

customers worldwide

Best Value

e-commerce software for 2022 on Capterra

Highly Rated

on software review platforms GetApp, Software Advice, and more

Frequently asked questions

What is e-commerce integration?

E-commerce integration is the coordination between your business’ Point of Sale or ERP software and your e-commerce platform.

What’s unique about WebSell?

We turn your Point of Sale or ERP system into the power behind your e-commerce. That means your entire business works from the same data source, from brick-and-mortar to online store. With WebSell, you get a unified commerce strategy which gives your business:

- Complete e-commerce platform,

- New webstore,

- Integrated sales touchpoints,

- Better customer relationships,

- More online sales!

How does WebSell help my business grow?

WebSell is a full service platform, meaning you can get more than an e-commerce platform. You can also avail of add-on services like:

- Digital marketing,

- Paid search,

- SEO,

- Custom development,

- Custom design,

- and more!

We don’t just get you selling online, we help you scale too.

What POS/ERP software does WebSell integrate with?

WebSell integrates with a number of leading POS and ERP systems including:

- Windward System Five,

- pcAmerica’s Cash Register Express,

- Retail Management Hero,

- LS Retail,

- Retail Pro,

- Microsoft Dynamics 365 Business Central,

- and more.

See our full list of POS/ERP integrations.

Don’t believe us? Listen to our customers.

“I could hand on heart recommend WebSell to anyone who’s looking for an e-commerce platform. Especially if you’re looking for something agile that allows you to come out of the gate at a rate of knots.“

ANDY DANKS

E-COMMERCE MANAGER, MY PET WAREHOUSE

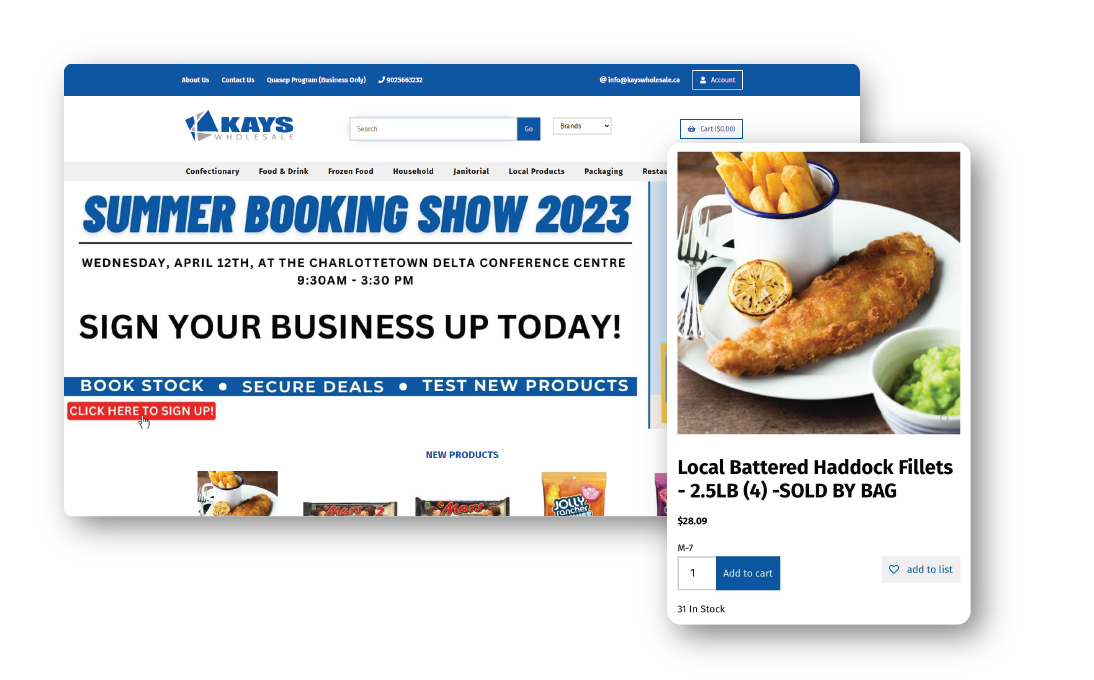

“WebSell has made getting online sales much simpler. We deal with large quantities and many different customers, so the integration was a real game-changer. It just works and we enjoy working with WebSell.”

LUKE BECK

OWNER, KAYS WHOLESALE

“Their integration with Retail Management Hero cuts everyday maintenance by 70%. It allows our staff to focus on other areas. Our e-commerce just works without having to constantly maintain it.”

RICH BENDALL

CEO, FORBIDDEN PLANET NYC

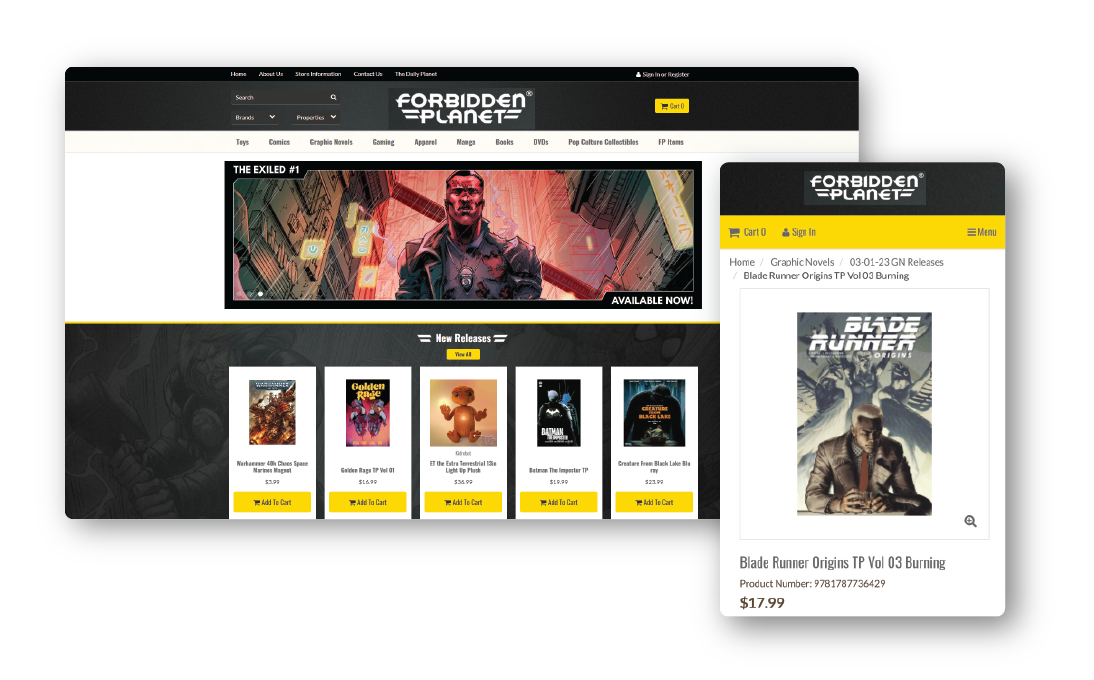

“We wanted a platform that could as closely as possible represent the in-store experience. We couldn’t survive without e-commerce now. Customers have the same experience online as they do in stores.”

SUZANNE SCHALLOW

CO-FOUNDER, CRAFT BEER CELLAR

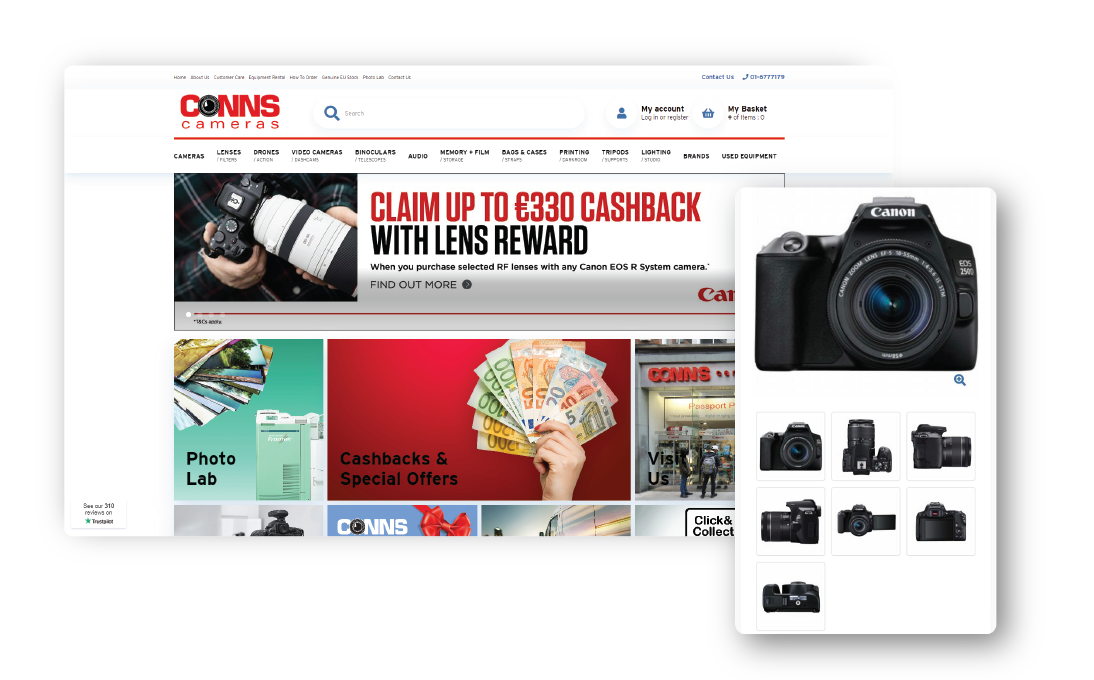

“The implementation process was very practical and encouraging. The collaborative approach was brilliant and made things easy. Development proceeded smoothly and allowed us to launch on schedule.”

GARETH CRAIG

IT MANAGER, CONNS CAMERAS

E-commerce Integration Experts

At WebSell, we’re specialists at e-commerce integrations. We’ve built a network of technology partners that we’re proud to work including POS & ERP systems, payment gateways, and online marketplaces like Amazon.

Some of the most popular POS/ERP systems we integrate with include:

Windward System Five

Get a responsive webstore that integrates directly with the Windward System Five ERP system.

Cash Register Express

Make more sales with the original e-commerce integration for pcAmerica’s Cash Register Express.

WebSell also integrates with:

Sell more online with WebSell

Request a demo to get your custom walkthrough of the platform.

Get the latest e-commerce tips and news

-

Leveraging Out-of-Stock Products for E-commerce Success

Running an e-commerce business can be a rollercoaster ride. You’ve got a specific product that’s become a customer favorite, and it’s selling like hotcakes. But there’s a catch – the item is out of stock. Your online store now faces the challenge of managing out-of-stock products. How can you navigate this situation to drive growth…

-

Mastering SEO-Optimized Product Descriptions for E-commerce

Product descriptions can make or break your sales. Crafting compelling, SEO-optimized product descriptions is a critical skill for online retailers. A well-written description can not only drive traffic to your product page but also convince potential customers to make a purchase. In this guide, we’ll show you how to write product descriptions that not only…

-

How to Craft the Perfect E-commerce Welcome Email

Today, we’re unraveling the art of crafting the perfect welcome email. In a world where first impressions matter more than ever, your welcome email is your digital handshake, setting the tone for your customer relationship. Let’s explore why it’s crucial to welcome new subscribers to your email list and gather some stellar ideas to make…